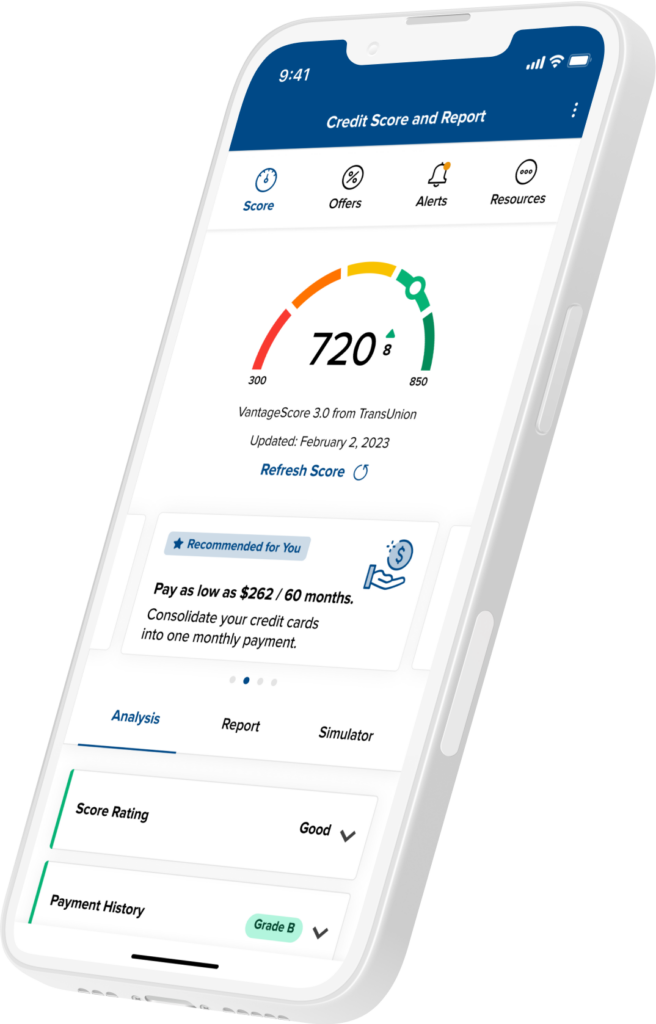

Take control of your credit score with our tool powered by SavvyMoney.

Access your credit score, credit report, personalized money-saving offers, and financial education tips on how to improve your score.

The member benefits of the credit score tool support our mission of Financially Empowering Central Iowa:

- It’s free without third-party ads

- Zero credit impact

- Daily credit score refresh available

- Credit monitoring alerts

- Full credit report

- Credit score simulator

- Credit scorecard and tips

- Credit score education

- Conveniently built into Online & Mobile Banking

Begin using Credit Score & Report free, right now! Simply enroll inside Online Banking or our Mobile Banking app.

Frequently Asked Questions

Have more questions? We’re happy to answer them! Call us at 800-245-6199 or submit a contact form.